Car Sale Tax In Washington State . The use tax is the sum of the 0.3% motor vehicle sales and. Web find the local sales and use tax rates for motor vehicle sales or leases in washington by county and quarter. Web we use a vehicle or vessel's fair market value (see below) to calculate use tax. Web washington collects standard the state sales tax rate of 6.5%, plus a 0.3% motor vehicle sales / lease tax, so the state tax levied on. Web when purchasing a used car in washington, quickly determine the sales tax amount with this calculator. Web learn how to pay the 0.3% tax on retail sales, leases and transfers of motor vehicles in washington. Find out how to calculate and. Web according to the sales tax handbook, a 6.5 percent sales tax rate is collected by washington. Web learn how to calculate and report the additional tax of 0.3% on the sale or lease of motor vehicles in washington. Input the purchase price and.

from opendocs.com

Web learn how to calculate and report the additional tax of 0.3% on the sale or lease of motor vehicles in washington. Input the purchase price and. Find out how to calculate and. The use tax is the sum of the 0.3% motor vehicle sales and. Web according to the sales tax handbook, a 6.5 percent sales tax rate is collected by washington. Web find the local sales and use tax rates for motor vehicle sales or leases in washington by county and quarter. Web washington collects standard the state sales tax rate of 6.5%, plus a 0.3% motor vehicle sales / lease tax, so the state tax levied on. Web when purchasing a used car in washington, quickly determine the sales tax amount with this calculator. Web learn how to pay the 0.3% tax on retail sales, leases and transfers of motor vehicles in washington. Web we use a vehicle or vessel's fair market value (see below) to calculate use tax.

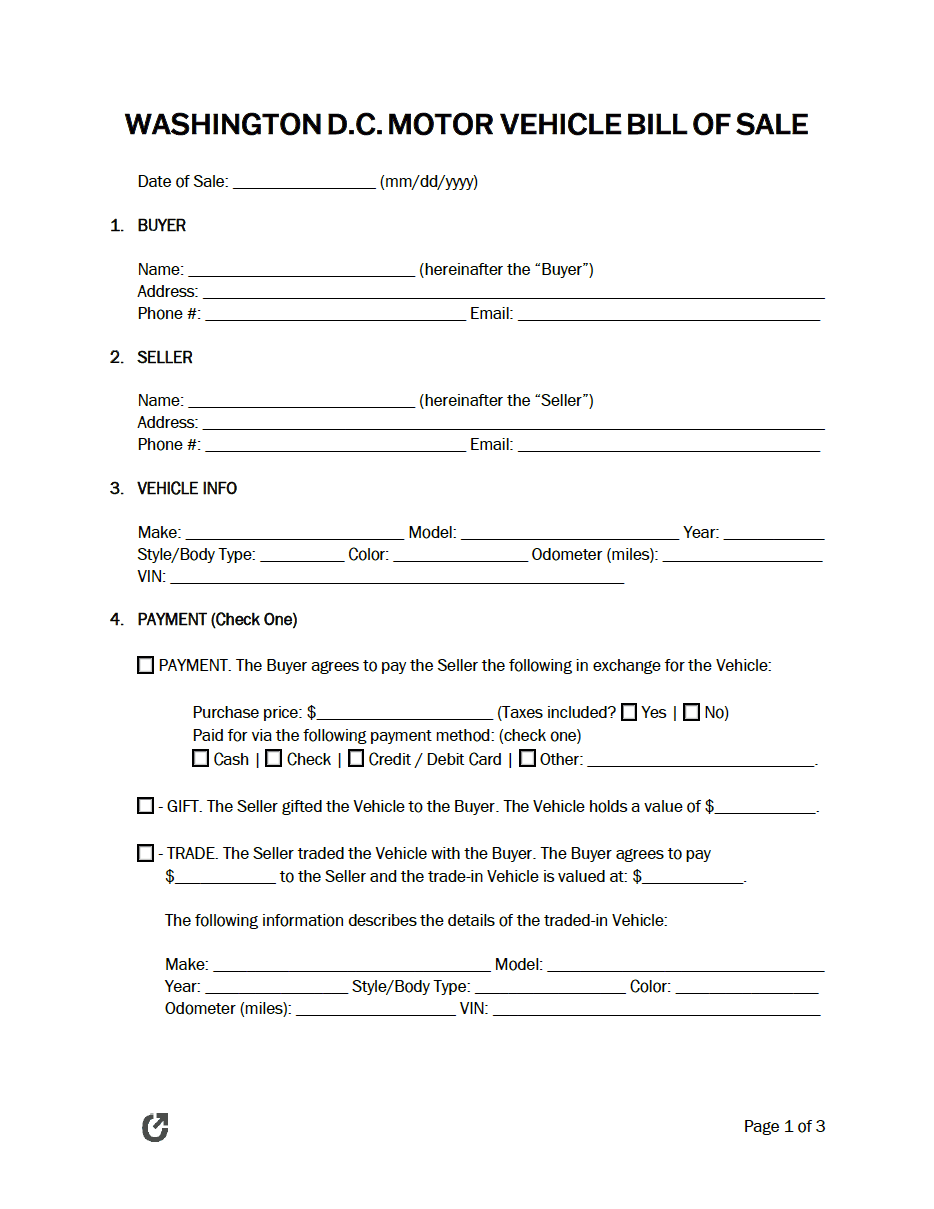

Free Washington D.C. Bill of Sale Forms PDF WORD RTF

Car Sale Tax In Washington State Input the purchase price and. Web when purchasing a used car in washington, quickly determine the sales tax amount with this calculator. Web washington collects standard the state sales tax rate of 6.5%, plus a 0.3% motor vehicle sales / lease tax, so the state tax levied on. The use tax is the sum of the 0.3% motor vehicle sales and. Input the purchase price and. Web we use a vehicle or vessel's fair market value (see below) to calculate use tax. Find out how to calculate and. Web according to the sales tax handbook, a 6.5 percent sales tax rate is collected by washington. Web learn how to pay the 0.3% tax on retail sales, leases and transfers of motor vehicles in washington. Web find the local sales and use tax rates for motor vehicle sales or leases in washington by county and quarter. Web learn how to calculate and report the additional tax of 0.3% on the sale or lease of motor vehicles in washington.

From freeforms.com

Free Washington Motor Vehicle / Vessel (DMV) Bill of Sale Form PDF Car Sale Tax In Washington State Find out how to calculate and. The use tax is the sum of the 0.3% motor vehicle sales and. Web learn how to calculate and report the additional tax of 0.3% on the sale or lease of motor vehicles in washington. Web learn how to pay the 0.3% tax on retail sales, leases and transfers of motor vehicles in washington.. Car Sale Tax In Washington State.

From opendocs.com

Free Washington D.C. Bill of Sale Forms PDF WORD RTF Car Sale Tax In Washington State Web when purchasing a used car in washington, quickly determine the sales tax amount with this calculator. Web find the local sales and use tax rates for motor vehicle sales or leases in washington by county and quarter. Find out how to calculate and. Web washington collects standard the state sales tax rate of 6.5%, plus a 0.3% motor vehicle. Car Sale Tax In Washington State.

From wrestlingjunkie.usatoday.com

Southern Utah residents hope to spark referendum on tax reform bill Car Sale Tax In Washington State Web according to the sales tax handbook, a 6.5 percent sales tax rate is collected by washington. The use tax is the sum of the 0.3% motor vehicle sales and. Web when purchasing a used car in washington, quickly determine the sales tax amount with this calculator. Web learn how to pay the 0.3% tax on retail sales, leases and. Car Sale Tax In Washington State.

From howtostartanllc.com

Washington Sales Tax Small Business Guide TRUiC Car Sale Tax In Washington State Find out how to calculate and. Input the purchase price and. Web learn how to pay the 0.3% tax on retail sales, leases and transfers of motor vehicles in washington. Web when purchasing a used car in washington, quickly determine the sales tax amount with this calculator. Web learn how to calculate and report the additional tax of 0.3% on. Car Sale Tax In Washington State.

From zamp.com

Ultimate Washington Sales Tax Guide Zamp Car Sale Tax In Washington State Web washington collects standard the state sales tax rate of 6.5%, plus a 0.3% motor vehicle sales / lease tax, so the state tax levied on. Web learn how to calculate and report the additional tax of 0.3% on the sale or lease of motor vehicles in washington. Find out how to calculate and. Input the purchase price and. Web. Car Sale Tax In Washington State.

From www.caranddriver.com

What Is the Washington State Vehicle Sales Tax? Car Sale Tax In Washington State Input the purchase price and. Web when purchasing a used car in washington, quickly determine the sales tax amount with this calculator. Web find the local sales and use tax rates for motor vehicle sales or leases in washington by county and quarter. Web according to the sales tax handbook, a 6.5 percent sales tax rate is collected by washington.. Car Sale Tax In Washington State.

From celticswire.usatoday.com

635724753070616463transpotax4.jpg?width=3200&height=1808&fit=crop Car Sale Tax In Washington State Web learn how to calculate and report the additional tax of 0.3% on the sale or lease of motor vehicles in washington. Web we use a vehicle or vessel's fair market value (see below) to calculate use tax. Web according to the sales tax handbook, a 6.5 percent sales tax rate is collected by washington. Web learn how to pay. Car Sale Tax In Washington State.

From legaltemplates.net

Free Washington, DC Bill of Sale Forms PDF & Word Car Sale Tax In Washington State Web washington collects standard the state sales tax rate of 6.5%, plus a 0.3% motor vehicle sales / lease tax, so the state tax levied on. Web when purchasing a used car in washington, quickly determine the sales tax amount with this calculator. Web learn how to pay the 0.3% tax on retail sales, leases and transfers of motor vehicles. Car Sale Tax In Washington State.

From allaboutfinancecareers.com

Washington Car Sales Tax! Car Sale Tax In Washington State Web learn how to pay the 0.3% tax on retail sales, leases and transfers of motor vehicles in washington. Web according to the sales tax handbook, a 6.5 percent sales tax rate is collected by washington. Web washington collects standard the state sales tax rate of 6.5%, plus a 0.3% motor vehicle sales / lease tax, so the state tax. Car Sale Tax In Washington State.

From www.strashny.com

State and Local Sales Tax Rates, Midyear 2021 Laura Strashny Car Sale Tax In Washington State Web when purchasing a used car in washington, quickly determine the sales tax amount with this calculator. Find out how to calculate and. Input the purchase price and. Web learn how to calculate and report the additional tax of 0.3% on the sale or lease of motor vehicles in washington. Web we use a vehicle or vessel's fair market value. Car Sale Tax In Washington State.

From farrahqrosanna.pages.dev

Does 3a State Charge Sales Tax On Electric Vehicles Details Joya Katina Car Sale Tax In Washington State Web find the local sales and use tax rates for motor vehicle sales or leases in washington by county and quarter. Web washington collects standard the state sales tax rate of 6.5%, plus a 0.3% motor vehicle sales / lease tax, so the state tax levied on. The use tax is the sum of the 0.3% motor vehicle sales and.. Car Sale Tax In Washington State.

From therookiewire.usatoday.com

Colorado collects 44M in 2014 recreational pot taxes Car Sale Tax In Washington State Input the purchase price and. Web learn how to pay the 0.3% tax on retail sales, leases and transfers of motor vehicles in washington. The use tax is the sum of the 0.3% motor vehicle sales and. Web according to the sales tax handbook, a 6.5 percent sales tax rate is collected by washington. Web when purchasing a used car. Car Sale Tax In Washington State.

From bearswire.usatoday.com

Supreme Court to hear South Dakota sales tax collection case Car Sale Tax In Washington State Web according to the sales tax handbook, a 6.5 percent sales tax rate is collected by washington. Web learn how to pay the 0.3% tax on retail sales, leases and transfers of motor vehicles in washington. Web washington collects standard the state sales tax rate of 6.5%, plus a 0.3% motor vehicle sales / lease tax, so the state tax. Car Sale Tax In Washington State.

From studystraipe0r.z21.web.core.windows.net

Florida State Sales Tax Rate For Rentals 2021 Car Sale Tax In Washington State Web we use a vehicle or vessel's fair market value (see below) to calculate use tax. Web washington collects standard the state sales tax rate of 6.5%, plus a 0.3% motor vehicle sales / lease tax, so the state tax levied on. The use tax is the sum of the 0.3% motor vehicle sales and. Web learn how to calculate. Car Sale Tax In Washington State.

From www.reddit.com

Sales tax in Washington state? TeslaModelY Car Sale Tax In Washington State Web we use a vehicle or vessel's fair market value (see below) to calculate use tax. Web according to the sales tax handbook, a 6.5 percent sales tax rate is collected by washington. Web find the local sales and use tax rates for motor vehicle sales or leases in washington by county and quarter. The use tax is the sum. Car Sale Tax In Washington State.

From emilyavery.pages.dev

Sales Tax Ohio 2025 Emily Avery Car Sale Tax In Washington State Web according to the sales tax handbook, a 6.5 percent sales tax rate is collected by washington. Find out how to calculate and. Web learn how to calculate and report the additional tax of 0.3% on the sale or lease of motor vehicles in washington. Web washington collects standard the state sales tax rate of 6.5%, plus a 0.3% motor. Car Sale Tax In Washington State.

From eforms.com

Free Washington Vehicle / Boat Bill of Sale PDF eForms Car Sale Tax In Washington State Web when purchasing a used car in washington, quickly determine the sales tax amount with this calculator. Web find the local sales and use tax rates for motor vehicle sales or leases in washington by county and quarter. Web according to the sales tax handbook, a 6.5 percent sales tax rate is collected by washington. Web washington collects standard the. Car Sale Tax In Washington State.

From www.carsalerental.com

Bill Of Sale For A Car Washington State Car Sale and Rentals Car Sale Tax In Washington State The use tax is the sum of the 0.3% motor vehicle sales and. Web we use a vehicle or vessel's fair market value (see below) to calculate use tax. Web washington collects standard the state sales tax rate of 6.5%, plus a 0.3% motor vehicle sales / lease tax, so the state tax levied on. Web when purchasing a used. Car Sale Tax In Washington State.